Digitales Building Lifecycle Management mit PrometriQ

Cloud-Plattform für das digitale Management von Immobilien und Infrastrukturanlagen über den gesamten Building Lifecycle

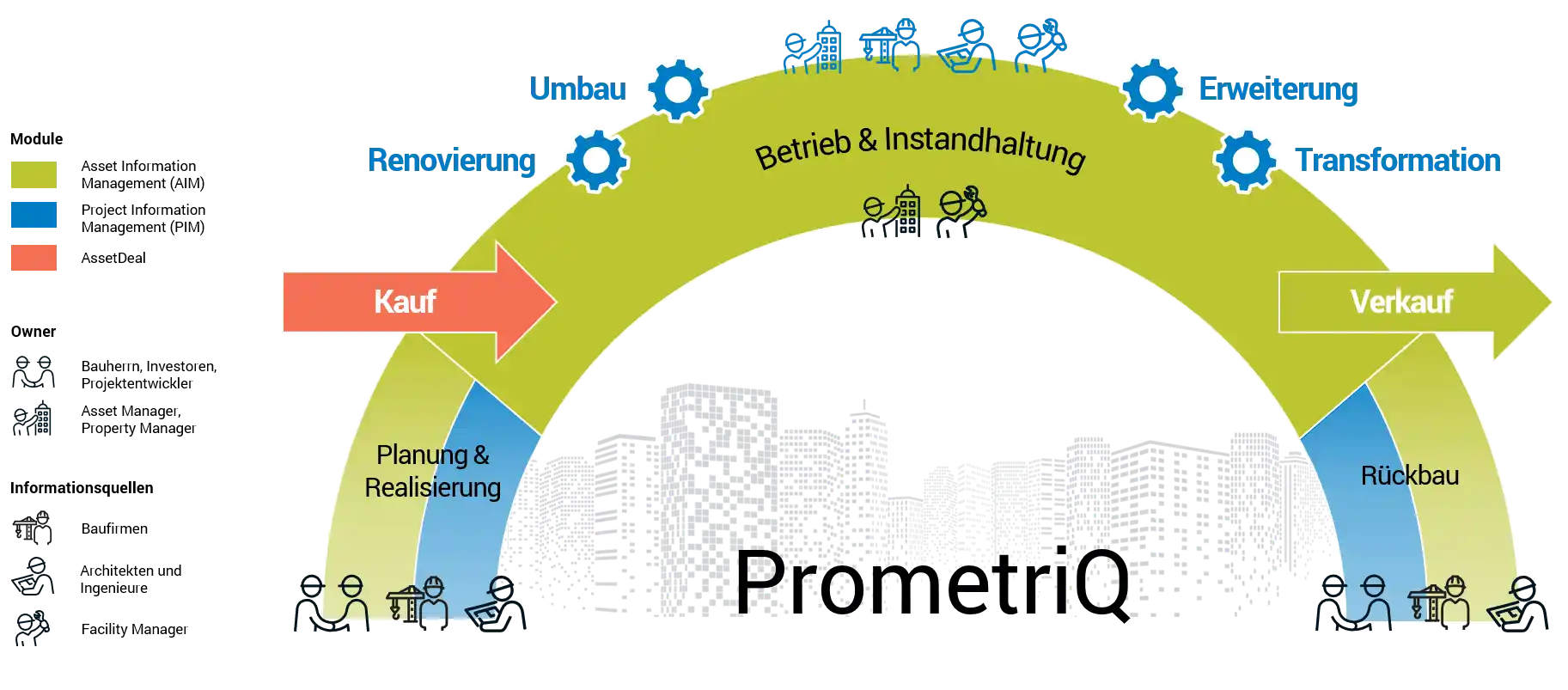

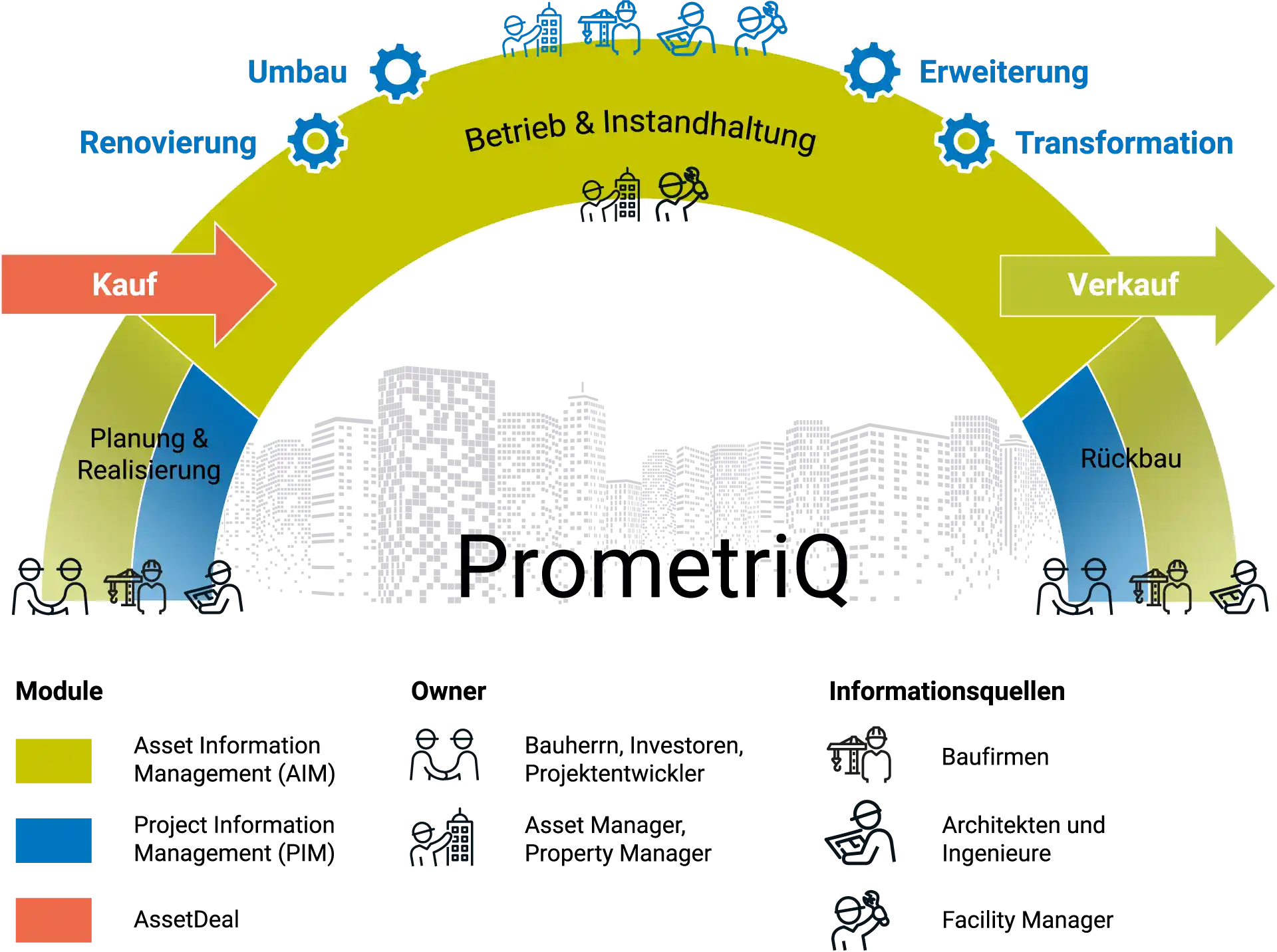

NeoTwin bietet seinen Kunden mit der BIM-fähigen Plattform PrometriQ eine Cloud-Lösung zur Verwaltung von Immobilien und Infrastrukturanlagen über deren gesamten Lebenszyklus. Die Owner (Investoren, Bauherren, Bestandshalter etc.) stehen dabei im Kundenfokus. Die Plattform unterstützt den Kunden bzw. interne und externe User durch die beiden Funktionsbereiche AIM (Asset Information Management) und PIM (Project Information Management).

Digitales Asset- und Projekt-Management im Building Lifecycle für Real Estate und Infrastruktur

PrometriQ stellt die mehr oder weniger komplexen Bauwerke, sprich alle baulichen Assets eines Owners, in den Mittelpunkt. Dies können bestehende Gebäude oder geplante Neubauprojekte sein. Die Plattform bietet zwei Hauptfunktionsbereiche, um die damit verbundenen Aufgaben zu erfüllen: Asset Information Management und Project Information Management.

AIM

Der Funktionsbereich AIM (Asset Information Management) strukturiert und dokumentiert zunächst den Assetbestand eines Owners. Darauf aufbauend werden alle relevanten Daten für das Management der Erlöse und Kosten in der Nutzungsphase zusammengeführt. Mehrere Assets können zu Portfolios zusammengeführt werden.

PIM

Projekte sind im Lebenszyklus von Gebäuden und Bauwerken ein wesentlicher Bestandteil. Nicht nur die Errichtung und der Rückbau sind komplexe Projekte. Auch Um-/ Erweiterungsbauten bzw. Renovierungsmaßnahmen werden als Projekte geplant und realisiert. Sie sorgen für die Werterhaltung eines Assets bzw. Portfoliobestandes, oder entwickeln das Asset auf ein höheres Level. Zur Unterstützung dieser Prozesse stellt der Funktionsbereich PIM (Project Information Management) von PrometriQ die notwendige Funktionalität zur Verfügung.

Technologie der NeoTwin Owner Plattform

Die Plattformarchitektur PrometriQ basiert auf Microsoft Azure in Verbindung mit Microsoft365 Cloud Produkten für die alphanumerische Daten, sowie den CDE-Produkten von Marktführern, wie z.B. Autodesk mit den Produktfamilien BIM360 bzw. Autodesk Construction Cloud (ACC) für die Verwaltung von 3D-Gebäudemodellen und 2D-Plänen. Somit entsteht ein ECO-System, welches die Unternehmen in die Lage versetzt, von ihren Daten zu profitieren. Die Plattform bietet alle datenabhängigen Strukturen, Rollen, Prozesse, Standards und Kataloge, die für Real Estate Fachanwendungen erforderlich sind. Dadurch wird der grundlegende Datenrahmen für wirklich produktive Fachanwendungen geschaffen. Die Harmonisierung von Daten und deren Austausch zwischen Unternehmen und ihren Geschäftspartnern werden auf eine zukunftsfähige Basis gestellt.

PrometriQ, die digitale Building Lifecycle Management Plattform für Owner von Real Estates und Infrastrukturanlagen

Karriere bei NeoTwin

Das PropTech Startup NeoTwin wurde im September 2018 in München von einem erfahrenem Team gegründet.

Unsere Überzeugung ist, dass wir für die Digitalisierung im Asset Management der Immobilienwirtschaft und im Projektmanagement für Neubau- , Umbau- und Sanierungsprojekte in der Bauwirtschaft den richtigen Ansatz gefunden haben und einen relevanten Beitrag leisten können.

NeoTwin ist ein dynamisches und wissbegierigen Team, das sich stetig weiterentwickeln und wachsen will. Wir sind daher immer wieder auf der Suche nach neuen Persönlichkeiten. In einem Satz: Nach Menschen, die gemeinsam mit uns die Immobilien- und Baubranche digitalisieren wollen.